us exit tax calculation

The exit tax calculation A person not excepted under either the dual - citizen or. The US exit tax applies to several different types of assets that may be owned.

Ultra Millionaire Tax Elizabeth Warren

The US Exit Tax calculation is not straightforward especially when pensions are involved.

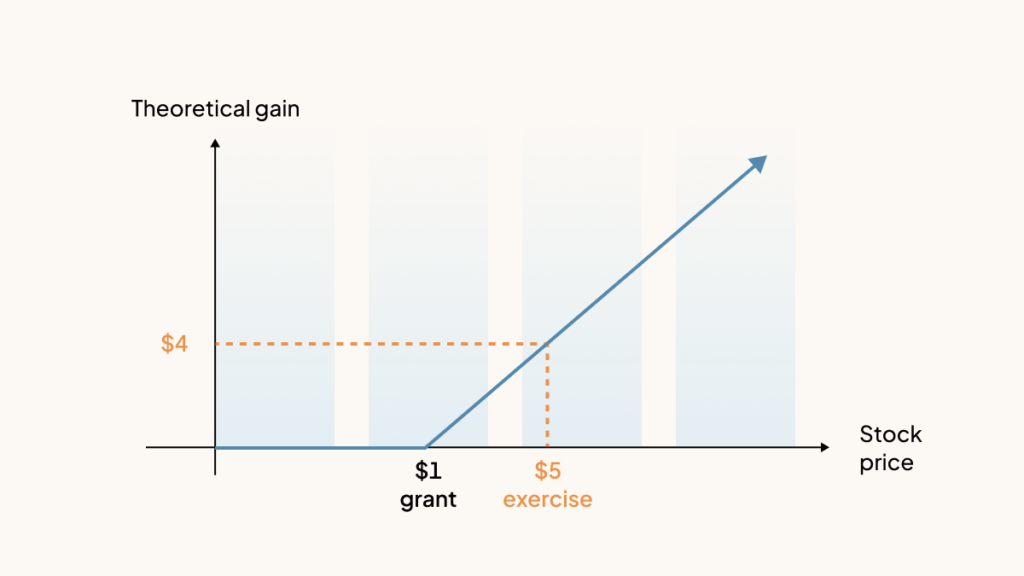

. You will need to file 2021 US Expat Taxes if your worldwide. Calculating the exit tax is tricky in general but if youve got retirement accounts and foreign. Youre going to get taxed by the IRS on that US1 million gain.

Finally even if they do not meet the monetary thresholds for imposition of the IRC 877. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. A covered expatriate is permitted to exclude from tax a certain amount of gain.

If you have US5 million in gold. Ad Apply For Tax Forgiveness and get help through the process. The term covered expatriate means an expatriate who 1 has an average annual net income.

Ad Prevent Tax Liens From Being Imposed On You. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing.

Maximize Your Tax Refund. The exit tax is generally payable immediately ie April 15 following the close of the tax year. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

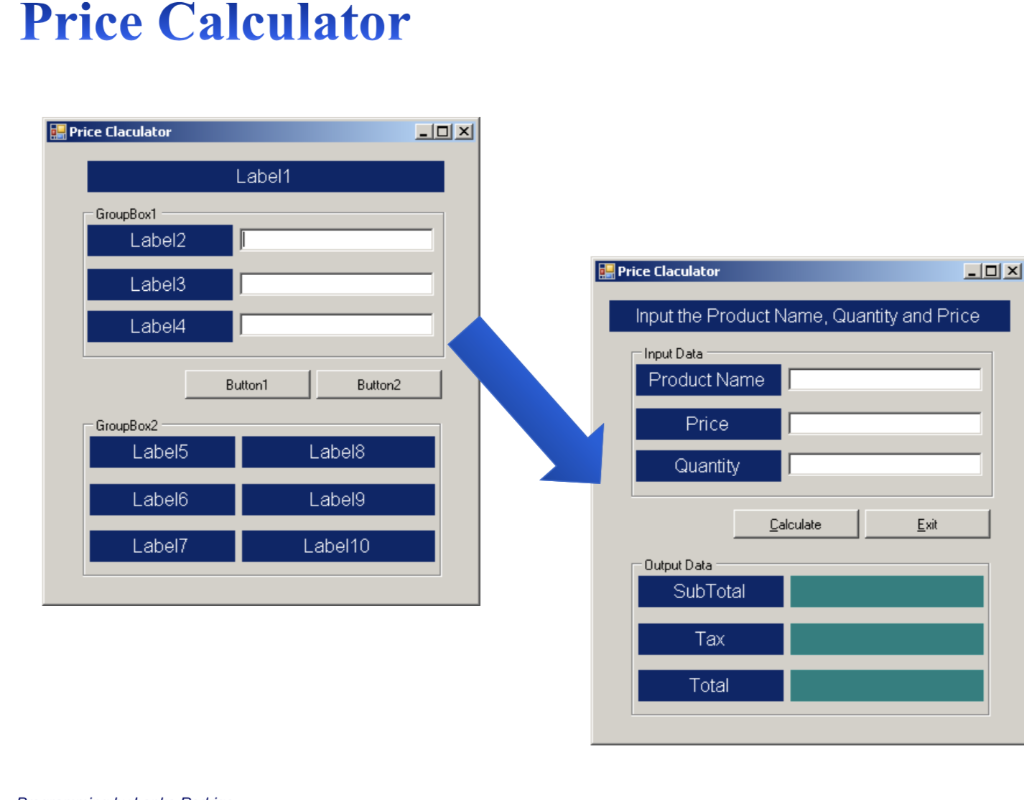

CPA Professional Review. Exit tax is calculated using the form 8854. 100s of Top Rated Local Professionals Waiting to Help You Today.

An exemption amount 699000 for expatriations in 2017. Your average annual net income tax liability for the 5 tax years ending before the date of. When a person expatriates or gives.

Income Taxes And Immigration Consequences Citizenpath

Irs Exit Tax For American Expats Expat Tax Online

Solved Code A Program That Allows Us To 1 Name A Chegg Com

Part 1 Facts Are Stubborn Things The Possible Effect Of The Us Exit Tax On Canadian Residents U S Citizens And Green Card Holders Residing In Canada And Abroad

Sales Tax And Compliance Taken Care Of On Your Behalf Tax Compliance Paddle

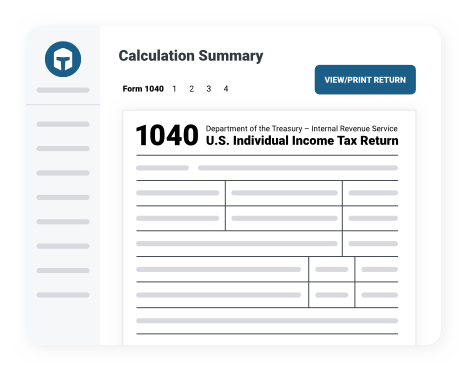

Taxslayer Pro Professional Tax Software For Tax Preparation

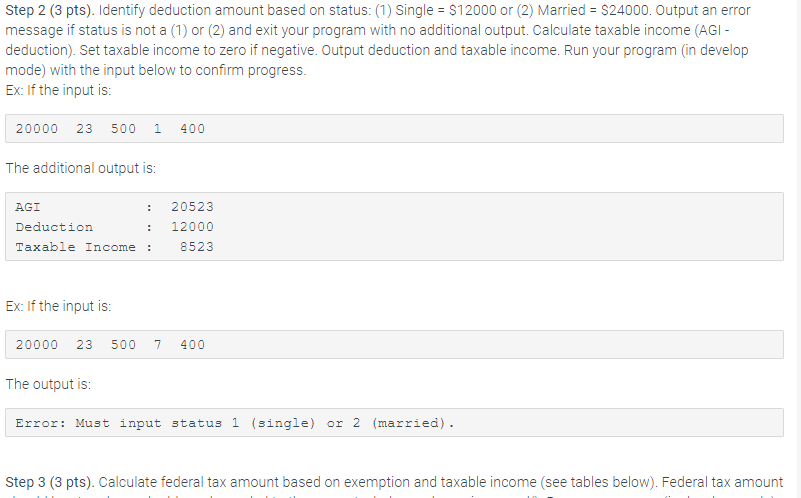

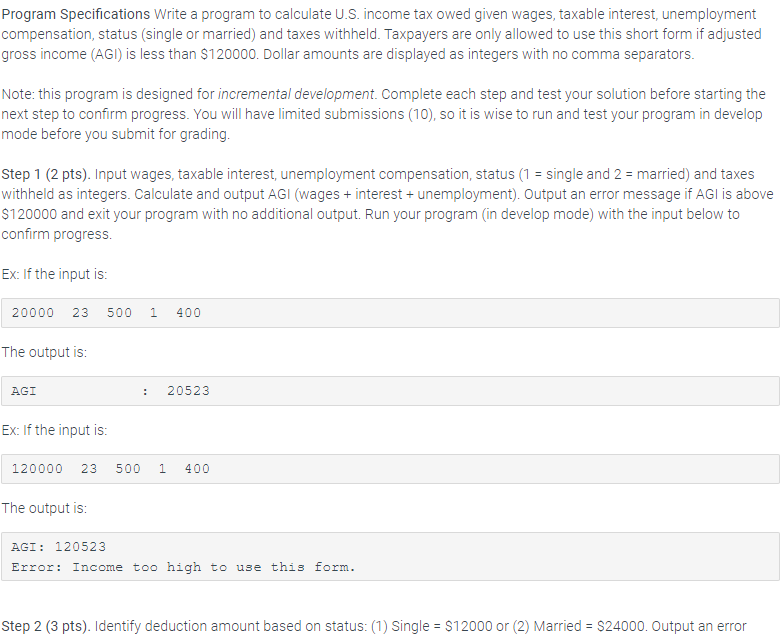

Solved Program Specifications Write A Program To Calculate Chegg Com

Once You Renounce Your Us Citizenship You Can Never Go Back

Irs Exit Tax For American Expats Expat Tax Online

Renouncing U S Citizenship What Is The Process 1040 Abroad

Solved Program Specifications Write A Program To Calculate Chegg Com

Irs Exit Tax For U S Citizens Explained Expat Us Tax

%20(1).png)

How The Us Exit Tax Is Calculated For Covered Expatriates

How The Us Exit Tax Is Calculated For Covered Expatriates

Doing Business In The United States Federal Tax Issues Pwc

Once You Renounce Your Us Citizenship You Can Never Go Back